what is the tax rate in tulsa ok

This is the total of state and county sales tax rates. Tulsa County OK Sales Tax Rate The current total local sales tax rate in Tulsa County OK is 4867.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

The December 2020 total.

. The Tulsa County Sales Tax is 0367. Tulsa County collects on average. Taxes are based upon budgets submitted by taxing jurisdictions and include the amounts necessary to pay.

Detailed Oklahoma state income tax rates and brackets are available on this page. This includes the sales tax rates on the state county city and special levels. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Some cities and local governments in Tulsa County. The Oklahoma state sales tax rate is currently.

Sales Tax in Tulsa. Some cities and local governments in Tulsa County. The tax must be paid on the occupancy or the right of occupancy of rooms in a hotel.

The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365. Tax rates sometimes referred to as millage rates are set by the Excise Board. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax.

A county-wide sales tax rate of 0367 is applicable. However left to the county are evaluating property mailing billings taking in the levies engaging in. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does.

Who is exempt from the tax. State of Oklahoma 45. While maintaining constitutional limitations mandated by law the city sets tax rates.

The December 2020 total local sales tax rate was also 4867. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Yearly median tax in Tulsa County.

The Oklahoma sales tax rate is currently 45. Tulsa has parts of it located within Creek. 4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa.

The average cumulative sales tax rate in Tulsa Oklahoma is 831. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022.

The City of Tulsa imposes a lodging tax of 5 percent. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Some cities and local governments in Tulsa County.

The minimum combined 2022 sales tax rate for New Tulsa Oklahoma is 98. This is the total of state county and city sales tax rates. 4 rows The current total local sales tax rate in Tulsa OK is 8517.

The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Oklahoma Sales Tax Small Business Guide Truic

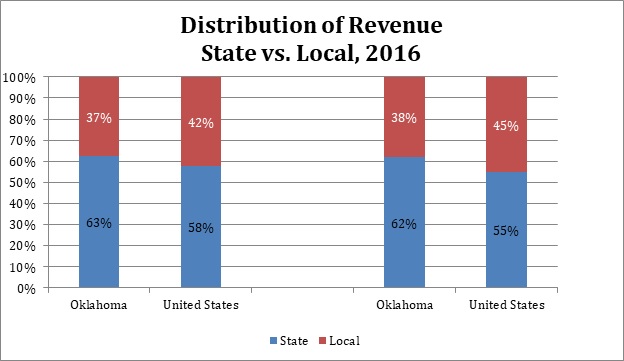

State And Local Tax Distribution Oklahoma Policy Institute

Ryan Aispuro Said Epic Terminated Her Employment Because She Resisted Pressure To Manipulate Epic S Truancy Standards Charter School School Fund Epic

The Mathematics Of Inequality Bruce Boghosian Runs The Numbers And Shows That Without Redistribution Of Wealth The Rich Inequality Mathematics Economic Model

The Best Places To Own A Home And Pay Less In Taxes The Good Place Estate Tax Tax

Individual Income Tax Oklahoma Policy Institute

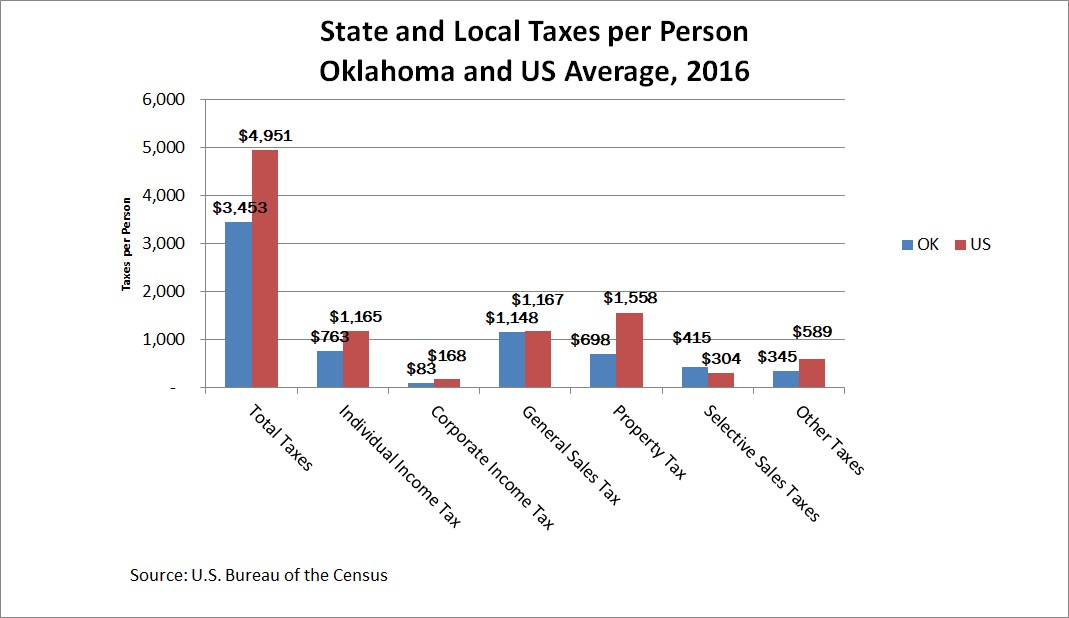

How Oklahoma Taxes Compare Oklahoma Policy Institute

The Impact Of The Coverage Gap For Adults In States Not Expanding Medicaid By Race And Ethnicity Kff Medicaid Family Foundations Participation Rate

How Oklahoma Taxes Compare Oklahoma Policy Institute

Oklahoma Lawmakers Studying Worsening Teacher Shortage Kesq Wall Of Sound Teacher Shortage Japanese Film

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Famous Gushers Of The World World Water Well Drilling Oil And Gas

House Will Study Virtual Charter Schools Charter School Virtual School Study

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute

Total Sales Tax Per Dollar By City Oklahoma Watch

Can I Have My Federal Student Loans Discharged If I Declare Bankruptcy In Tulsa Oklahoma Debt Management Plan Debt Relief Debt Relief Programs

5 Things You Should Know About Oklahoma Taxes Oklahoma Policy Institute